Engage

Designing Financial Services under EU Open Banking

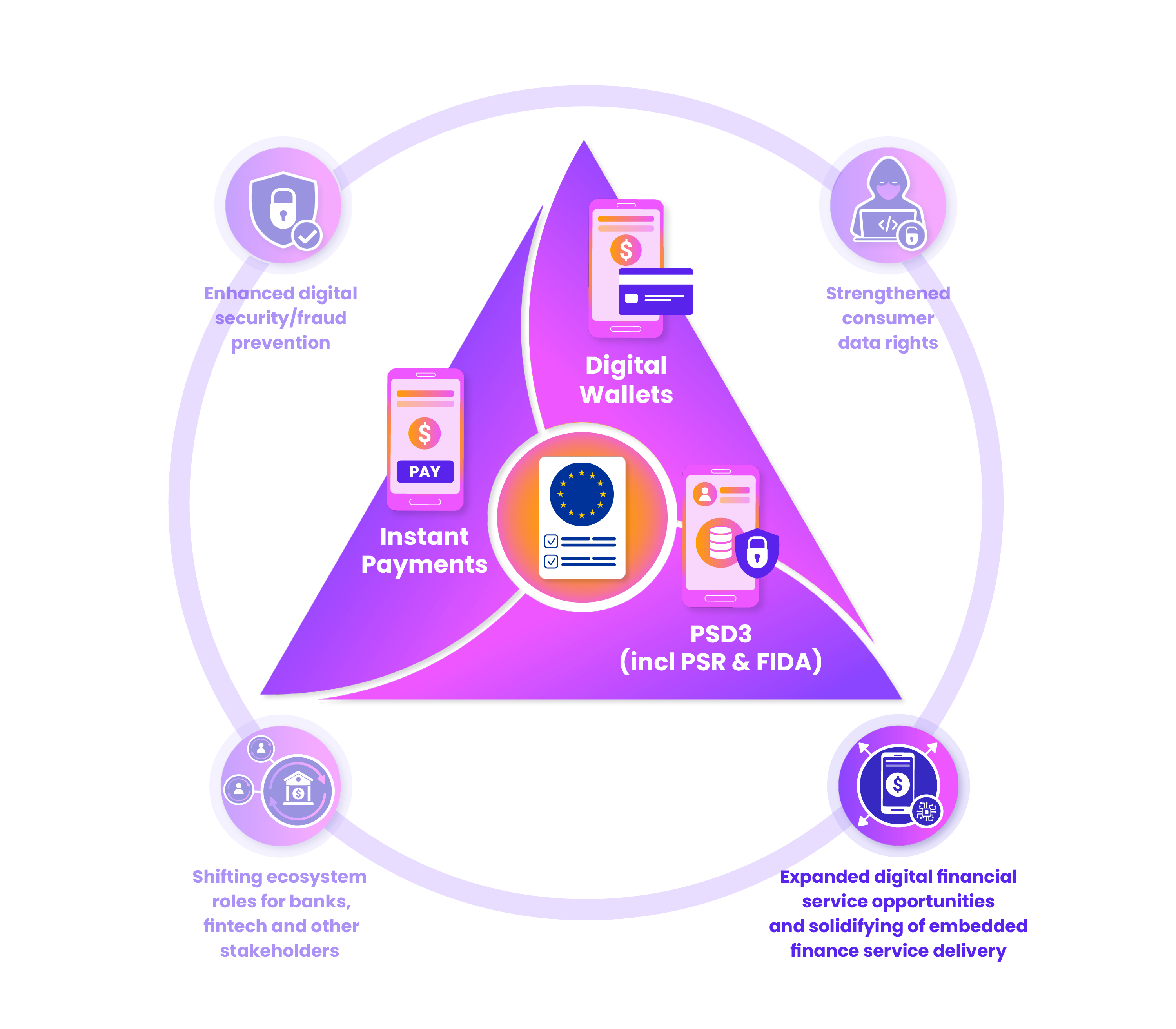

We have been taking a deep dive into three emerging open banking regulations that will evolve the open banking/open finance landscape in Europe and that will ripple out across the world. We have provided an overview of the next evolution of the EU open banking regulations, which we are calling the EU open banking regulation triumvirate, the potential impacts on security and fraud prevention, on consumer privacy and the roles of existing stakeholders, and today we finish with a look at how the regulations could propel a new generation of innovative digital financial products and services. We also discuss similar regulations around the world and touch on a fourth regulation: The European digital currency.

Theme 4: Expanded digital financial service opportunities and solidifying of embedded finance service delivery

| Regulation | Instant payments regulation | eID and Digital Wallets regulation | PSD3 |

|---|---|---|---|

| How this theme is addressed | New financial services can be offered in embedded banking at the point of sale that are also instantly paid, allowing consumers to have more choice. The availability of instant payments alters some consumer benefits received through credit purchases. For example, some consumers prefer paying their credit card bill in one sum at the end of each month or to have their purchases accumulate loyalty points. We imagine new alternatives that provide these kinds of value for instant payment users will emerge in future. | Digital wallet providers can seamlessly integrate banking and other financial services into their platforms, enabling new secure services to be provided by digital wallet providers. New data and document storage services for corporate clients could emerge from digital wallets providers, especially from banks. | Aims to overcome obstacles to data sharing to enable more value-added services to be created, especially across national borders within Europe. For cross-border payments, financial institutions will be required to inform users of the estimated charges for currency conversion and estimated time for transfer so that consumers can compare and access other services instead if they wish. Under PSD3, payments institutions are also given the right to grant some credit (although Buy Now Pay Later services are not seen as payment institutions and are covered by new directives on consumer credit). |

The combination of the three regulations will impact on the emerging embedded finance sector and create multiple opportunities for more open banking and open finance products and services. All three regulations are at least partly motivated by a desire to expand the choices available to consumers.

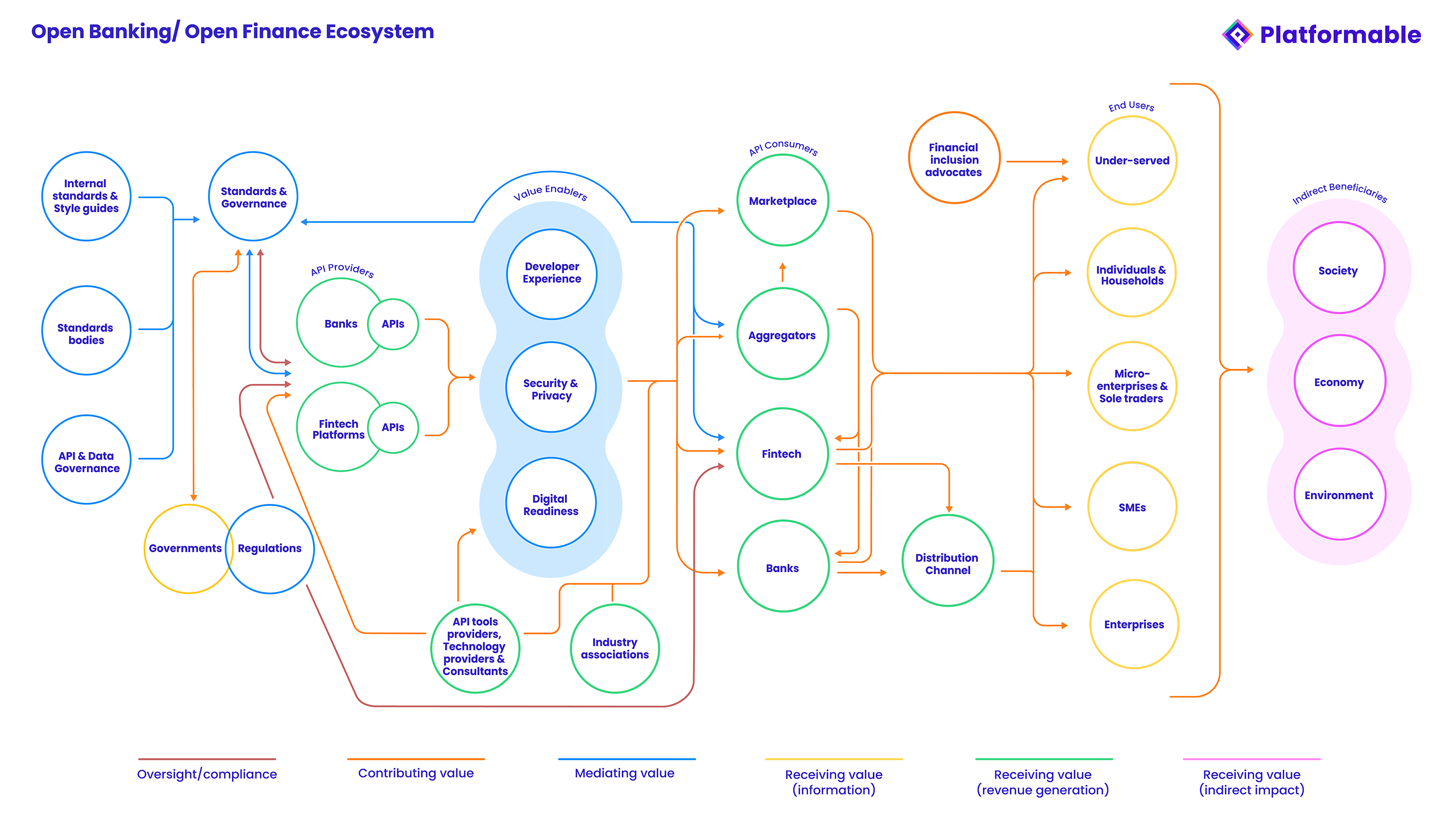

In our ecosystem model above, and as discussed in detail in our post on security and fraud prevention, we note that digital readiness (customer capacity to use fintech apps and understand their data sharing rights, for example) and security and privacy (where customers won’t even use the fintech if they think there are fraud or security risks) are value enablers. That is, the higher the digital readiness, and the more robust the security and privacy, the more customers will make use of open banking/open finance products and services.

In terms of strengthening security and privacy as an enabler, we believe the instant payments and PSD3 rules that introduce Verification of Payee (VoP) and create a payment services provider responsibility for reimbursement could potentially be a game changer in terms of adoption of open banking and open finance products and services. These rules increase the clarity that consumers have when transferring money digitally: they can confirm that whoever receives the money is their intended recipient and if for some reason that isn’t verified, the payment services provider is responsible for reimbursing the money if it is sent to a fraudulent or incorrect account. The VoP approach also provides greater clarity for merchants and online retailers, embedded finance providers and any digital organisations that offer online payment acceptance in some way: it ensures they are connecting with legitimate customers in this age of phishing and other scams, hacks, and AI misinformation.

Some potential new services enabled from these regulations are discussed in the previous blog post on changing ecosystem roles, but there are a whole range more that could be tested. A very quick back-of-the-envelope brainstorming includes:

- For identity: Services that enable faster onboarding/account setup for merchants, government departments, utilities, and so on; access to government and other essential online services (banks, utilities, transport, etc); enhanced e-signature options; consent management for data sharing activities and sharing data on the value that the consumer or society receives from the data sharing.

- For payments: Perhaps there are new variable recurring payment (VRP) options, for example, we would love to see VRP used in combination with Buy now Pay Later for those users who need greater flexibility in their repayments; unbundling of payments services from other value-added services in order to increase the adoption of non-payment related services (like Stripe is currently doing).

- For account information: One of the services we would like to see is an ability for users to connect their account information with their Buy Now Pay Later (BNPL) at the checkout to be informed if the instalment plan is actually unsustainable based on their recent account history. On the face of it, BNPL might not see the business model in this: but perhaps users could save the purchase to their favourites and be informed when their account transaction data suggests they could take on a new BNPL agreement, promoting financial literacy for the shopper and ensuring the continued viability of the customer for the BNPL provider. (Surely AI could help with this?)

- For instant payments: This could also make embedded financial services at the point of sale more possible as customers could immediately purchase related services at that time. For example, on travel sites, customers could pay for guided tours or rental cars instantly alongside their hotel or flight accommodation, perhaps receiving a discount or loyalty reward for locking in the purchase. Embedded insurance at the point of sale could be immediately paid to the insurtech provider, with perhaps an offer of a lower premium for the immediacy of payment.

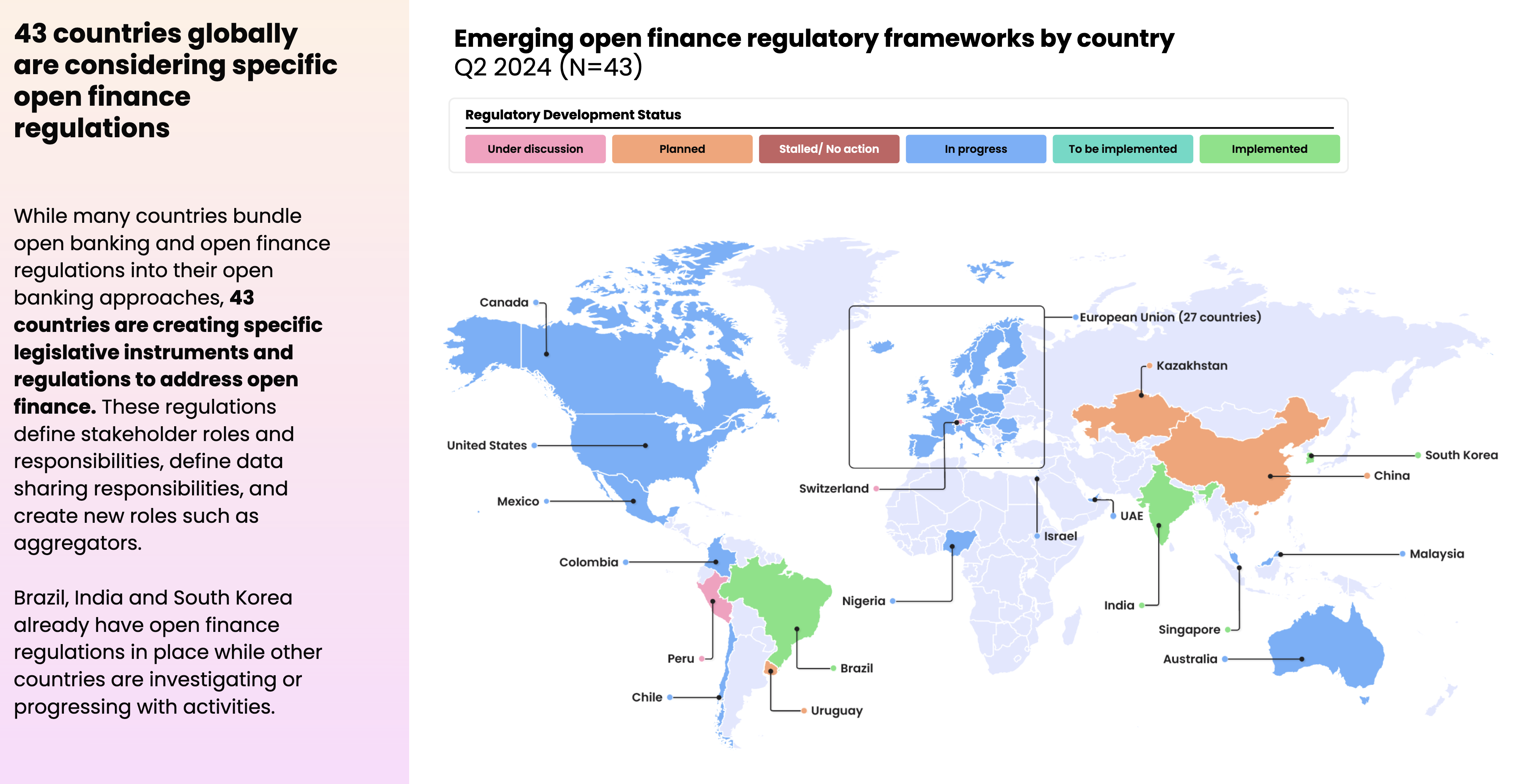

Similar regulations around the world

The regulation milestone maps in our Q2 Open Banking/Open Finance Trends Report details all upcoming regulations from around the globe that will impact on ecosystem stakeholders. In particular, activities in the UK, Australia and Brazil are currently focused on aspects of instant payments and data sharing. New Zealand and India have also announced new account verification payments processes.

UK started with a similar model called Confirmation of Payee at an earlier stage than Europe, and has recently extended the scheme to cover payment services providers. For reimbursement, the UK originally introduced a voluntary reimbursement scheme for financial institutions, but with widespread success where UK consumers have been reimbursed hundreds of millions of pounds, regulations are being introduced to mandate reimbursement.

In Brazil, new recurring instant payments services are being mandated to enable cross-service transfers between payments services providers by October this year.

In Australia, banks have been required to introduce new name-checking verification processes to reduce fraud.

Where digital currency regulations fit in

There is one more European regulation that sits alongside these three major regulatory approaches: The Digital euro package.

While this work is progressing, we are less bullish on the impact this will have in the near term. We know there is a lot of interest in digital currencies, partly as a hangover from cryptocurrency, which we continue to be sceptical about. Cryptocurrencies are speculative and there are no real use cases outside of trying to encourage others to invest in crypto so your own holdings increase in value. The wide use of cryptocurrency for ransomware and money laundering, the exorbitant energy use which we have been promised for years was something that was going to be addressed in the near future, and the inherent disparities and concentration of power amongst the investors and crypto/web3 governance mechanisms all suggest that cryptocurrency is ill-suited for widespread adoption. We track crypto financial services as part of our open banking datasets, but we are reluctant to highlight their potential in enabling value to be generated and distributed amongst stakeholders. Digital currencies, while different, do have some similarities: the use case is unclear and we are uncertain the energy use of infrastructure to enable digital currencies has been addressed as yet.

What is the use case of digital currencies that will not be addressed by the digital identity wallet and regulations like instant payments? In these cases, we have a trust framework and money acts in a digital flow in any case. When we make instant payments, the money automatically shows in our bank accounts and often we spend directly on another online service, never actually touching the cash. The preparation phase of the digital euro project started on 1 November 2023 and will initially last two years. It will involve finalising the digital euro rulebook and selecting providers that could develop a digital euro platform and infrastructure. We are taking a watch-and-see approach. I am sure there are stakeholders who want to prepare for possible opportunities and I understand the need for large banks to participate actively in discussions and directions, but for the bulk of the open banking/open finance ecosystem, we recommend a focus on the immediate horizon and opportunities of the regulations outlined in this article.

Next steps for stakeholders: what to work on for the rest of 2024

As noted by the regulators themselves, these regulations do not reflect a fundamental shift in the open banking landscape in Europe, but they do reflect a significant evolution towards a data economy and a single digital market, and enable digital infrastructure and ecosystem approaches to become the core banking/finance model moving forward.

The fast-paced deadlines, that commence in January 2025, will require action now from all stakeholders: banks, fintech, aggregators, consumer associations, tyhe API industry and regulators.

Contact us if you would like to discuss some of the ideas presented here fiurther or if you would like help with data and research, policy responses, aligning with best practices, building go to market strategies, addressing data governance needs, or mapping emerging opportunities. Subscribe to our open banking trends report or to our newsletter to dig into relevant data that will help you plan your next moves.

Mark Boyd

DIRECTORmark@platformable.com

Mariana Velázquez

SENIOR ANALYSTmariana@platformable.com